SOURCE: Photo

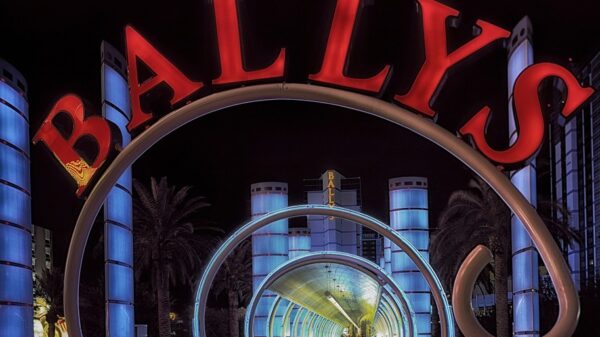

One of the UK’s leading iGaming software development studios has strengthened its links with up-and-coming iGaming studios to further enhance its portfolio of slot and table game titles. Gamesys, which was founded by a small band of software developers in early 2001, has grown into a public limited company that was recently acquired by US casino giant Bally’s Corporation in October 2021. For some time Gamesys has been one of the leading iGaming software suppliers of many UK-licensed operators. According to oddschecker’s latest online review of Virgin Bet, the Richard Branson-led casino brand is powered largely by Gamesys titles, alongside those from SBTech. That’s largely due to Gamesys’ very own acquisition of Virgin Games back in January 2013.

Now, Gamesys has sealed agreements with both Gaming Arts and RAW iGaming to enable it to access their full library of titles for launch into their regulated B2C markets online. Gaming Arts CEO, Mike Dreitzer, described the partnership as a “truly defining moment” for the studio. Dreitzer said its deal with Gamesys is one of the studio’s “first forays” into the iGaming scene. Dreitzer spoke of his excitement at Gaming Art’s opportunity to reach out to an “entirely new segment” of gamers.

Gaming Arts gravitating towards the iGaming scene

Dreitzer intimated that this was only the “first aspect” of a long-term partnership with Gamesys, with aspirations for a wider “omnichannel strategy” that would see Gaming Arts supply best-in-class casino gaming titles in the online space as well as retail casino environments, where the company has long since specialised. Gaming Arts is headquartered in the gaming capital of the world, Las Vegas, and has been successful in the supply of end-to-end gaming equipment technology of land-based gaming machines, including bingo and keno outlets.

Meanwhile RAW iGaming has also penned a bold agreement with Gamesys to commit its full suite of online casino games to its regulated B2C markets, namely Jackpotjoy, Virgin Games and Rainbow Riches Casino. RAW iGaming is a studio that’s making its mark fast on the iGaming software development circuit. It was only established at the back end of 2021, as the brainchild of the development experts at Videoslots. The firm has undergone M&A activity within the opening months of its launch, bringing the Leander Games team in-house. Leander Games already had its games live in 13 regulated iGaming markets, which was another attraction to the Malta-based studio.

Tom Wood, CEO, RAW iGaming, described Gamesys has having an “incredible track record” in the iGaming industry. Wood believes that the fledgling studio will benefit hugely from “working closely” with the Gamesys team to “perfect” its up-and-coming products.

RAW iGaming considers their video slot games to be wholly unique to those from other providers. That’s because its titles are underpinned by bespoke game engines, called SuperSlice and SuperTracks. Its SuperSlice game engine comes into its own with wheel-based casino games. SuperSlice implements ‘dynamic’ slices within a wheel, so gamers can never be certain how many slices will land on a wheel or what they will end up holding.

Nick Wright, senior vice president of business development for Interactive at Gamesys parent Bally’s, said the firm was “proud” to usher in this new form of wheel-based gameplay to regulated iGaming markets.

Gamesys’ parent company Bally’s Corporation goes from strength to strength

While Gamesys continues to cement its position in the regulated B2C iGaming market, parent company Bally’s Corporation is thriving both on and offline. The iconic American gaming brand posted its Q1 2022 trading update with revenue weighing in at an impressive $548.2m. To put this in context, this equated to a 185.1% year-on-year increase, prior to the £2bn merger with Gamesys.

The Q1 2022 figures demonstrate just how much of an impact Bally’s acquisition of Gamesys has made to its bottom line in such a short space of time. Its revenue from the gaming sector was up 198.6% year-on-year, equating to most of its quarterly income ($463.7m). Despite “international interactive” revenues being down 1% year-on-year, due largely to the tightening of belts among consumers throughout Europe, Bally’s has seen solid growth in regulated Asian and North American markets.