BRB, the Broadcasters’ Audience Research Board, has released its latest survey showing two-thirds of the UK has at least one SVOD service (and often more)

We like statistics, and thanks to BARB we have some good, recent data on UK SVOD take-up. [If SVOD and means nothing, our handy guide might help]. You can read the BARB report here; we pick some of our highlights.

The figures are for Q2 2021, and the first conducted by interview (1,000 interviewees) since the pandemic.

The headlines

Here’s the big number:

The number of UK households with a subscription to any SVOD service is now 18.8 million homes (66%), up from 17.4 million in Q3 2020

It strongly supports the theory demand is increasing, despite easing of lockdown. We were particularly interested in this part of the report:

more homes have multiple SVOD subscriptions. The proportion of homes with an SVOD service that subscribe to two or more services has risen to 65.3%, up from 58.3% in Q3 2020

If we take a moment to deconstruct, two-thirds (all but) of the two-thirds of the UK has two or more subscriptions. By our calculations (we checked twice!) this means 43% of the UK has at least two. We’d be fascinated to see this broken down — for example is most people’s second subscription Amazon Prime to get free delivery?

The details

Here’s the specifics:

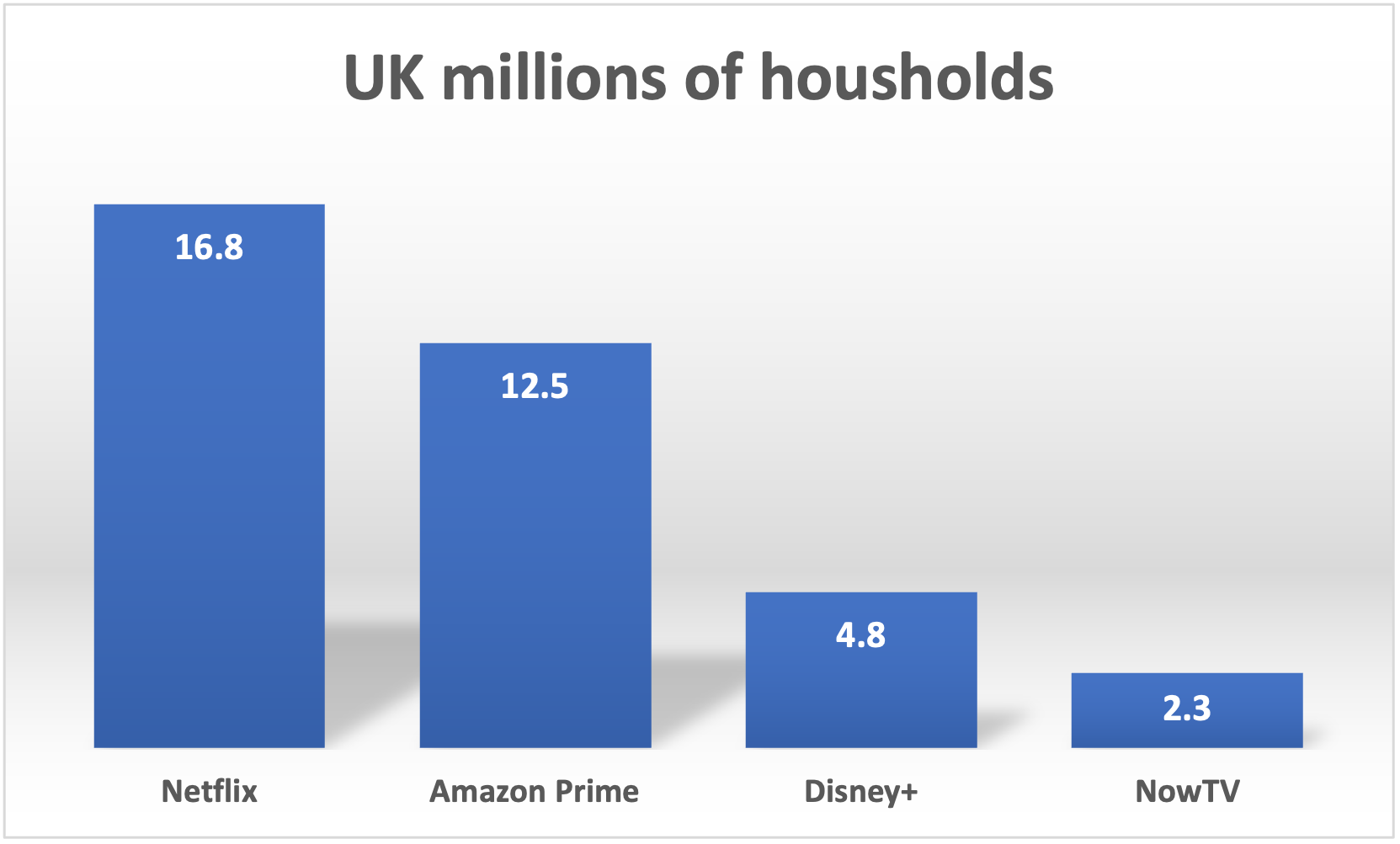

All of the main services have seen growth, with market-leader Netflix increasing to 16.8m households in Q2 2021, up more than 1.5m since Q3 2020. Amazon Prime Video saw a larger growth in households than Netflix, increasing over 2.3m homes to 12.5m. The largest percentage-change in the market was from Disney+, which is growing from a smaller subscriber base than Amazon and Netflix, having launched in March 2020. In Q2 2021, Disney+ was available in 4.8m households, up 24% since last time. NowTV also increased, to 2.3m homes.

Here’s a graph if that helps:

This provides useful context in a world often swamped with US oriented data.