Netflix earnings figures have disappointed many observers, and the streamer is called-our for ‘losing momentum’. Even with the impact of the pandemic, it’s clear things have changed, but we see that as continued Netflix evolution at work

We been mulling over the Netflix quarterly earnings (which you can find on their corporate site) and debated how to present them. We’ll give you a thumbnail view of what they say, give some example reactions among observers then give our own sense of the shifting shape of the streamer. It’s all opinion, not investment advice.

The Q2 figures — it’s mostly about Covid

You can read the letter to shareholders, giving the streamers view on the data. Here’s the opening paragraph:

In Q2, revenue increased 19% year over year to $7.3 billion, while operating income rose 36% year over year to $1.8 billion. We finished the quarter with over 209m paid memberships, slightly ahead of our forecast. COVID has created some lumpiness in our membership growth (higher growth in 2020, slower growth this year), which is working its way through. We continue to focus on improving our service for our members and bringing them the best stories from around the world.

The letter goes on to talk about revenue, improvements in margin and growth of subscriber base globally. They cherry-pick some successes:

Shadow and Bone… proved to be very popular with our members. Over 55m member households chose to watch this show in its first 28 days and we’ve renewed it for a second season. Sweet Tooth, based on the beloved DC comic, was another hit series with 60m member households choosing this title in its first four weeks. [also renewed since the letter was written]

They then cover non-fiction and films (including Army of the Dead was a blockbuster as 75m member households) before noting the Emmy nomination success talking about The Crown, The Kominsky Method, The Queen’s Gambit, Cobra Kai, Emily in Paris and Bridgerton.

They note non-English language productions (Lupin as the torchbearer) before dwelling on continued Covid uncertainty. Then comes the move into gaming.

Netflix and gaming

Here’s the Netflix statement — we come back to it later:

We view gaming as another new content category for us, similar to our expansion into original films, animation and unscripted TV. Games will be included in members’ Netflix subscription at no additional cost similar to films and series. Initially, we’ll be primarily focused on games for mobile devices. We’re excited as ever about our movies and TV series offering and we expect a long runway of increasing investment and growth across all of our existing content categories, but since we are nearly a decade into our push into original programming, we think the time is right to learn more about how our members value games.

Sample reactions — the streamer stalls as momentum is lost to competition?

First up (and it’s a small survey) we read the Variety analysis: Netflix Growth Sputters in Q2, Streamer Plans to Launch Video Games for No Extra Charge. It’s a good headline and goes into subscriber base loss in the US and Canada, compensated by growth international markets (led by Asia-Pac). It also has various quotes from Netflix management, which we won’t duplicate.

Parrot Analytics has an in-depth analysis: Netflix Q2 2021 earnings: The true impact of competition and again we recommend it. They give insight based on their extensive datasets, and suggest churn is actually low compared to competitors, but demand has dipped markedly. This is where they see the impact of other streamers. They have interesting insight into the types of show the audience needs, and it’s a mix. They focus on Lucifer and Cobra Kai as their exemplars. They then discuss delays in releasing popular series (due to Covid), what types of show should be bought in, and the importance of both licensed and original content.

If you scan the more financial websites, general mood is the data is mixed and several factors are at play.

Our view — the Netflix evolution continues

Business analysis of numbers (and money in particular) are subject to their own rigours. They like a degree of growth and the sense a business knows where it is going. They all understand the pandemic change things, but they also saw the huge spike in consumers during lockdown and want to see evidence Netflix can retain that growth at least as well as everyone else.

Some write-ups orient on the story of ‘Netflix not where it used to be…’ and predict doom and gloom. These are easy headlines to write (and we’ve no doubt been guilty of the same in some areas). If we pull back, and take a longer view, some things are clear:

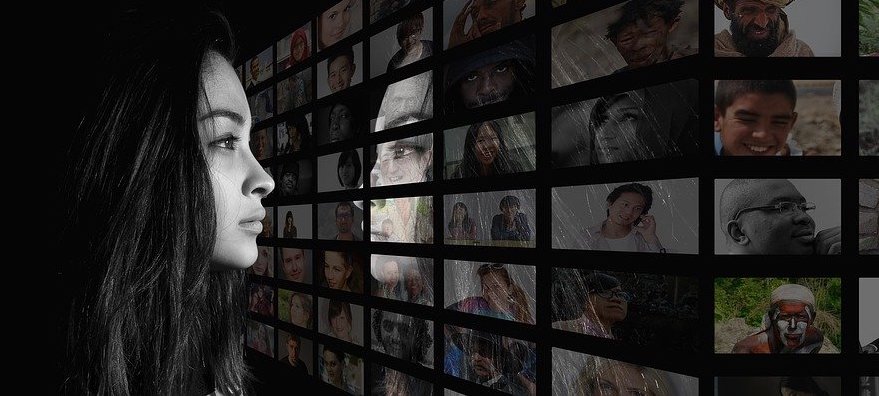

Netflix dominance has changed. This is not the same market it once was — Netflix is not the only big player now, and despite the assumptions in some business models, the audience is finite. Even if there is plenty more market growth to come, Netflix is not the only player in this market

The market is still emerging (suppliers). Netflix is looking at gaming, growth varies by geography, and the wider marker is still seeing new entrants and various mergers and acquisitions. It’s about new content and depth of content as well

The market is still evolving (consumers). A lot of people are still to move to serious SVOD (Streamed Video on Demand) vs other ways to get content. Let’s look again at the Netflix letter…

Here’s the section on Competition in the shareholder newsletter:

We are still very much in the early days of the transition from linear to on-demand consumption of entertainment. Streaming represents just 27% of US TV screen time, compared with 63% for linear television, according to Nielsen. Based on this same study, Nielsen estimates that we are just 7% of US TV screen time. Considering that we are less mature in other countries and that this excludes mobile screens (where we believe our share of engagement is even lower), we are confident that we have a long runway for growth. As we improve our service, our goal is to continue to increase our share of screen time in the US and around the world.

If that all pans out, we have to agree, even though Netflix is not the only organisation feeding in these waters.

Will Netflix diversify?

We wonder if Netflix will begin to vary its offering. At present you pay a fee for access to everything. More money gives you more screens or higher definition. While we agree some users may like a bundled games library, there’s a demographic who won’t. We’d see a case for fragmenting the offering (eg games aren’t free on lower tier subscriptions) but doing so may make it hard for the marketing to focus.

We don’t see Netflix grouping content by type. You could argue Netflix could ‘split into channels’ with Netflix Film, Netflix Originals, Netflix Classics, Netflix Documentaries… and so forth. It’s all just labelling, but does remind us of Sky. As consumers start to get squeezed (ie want multiple streamers who are all raising prices), they will want ways to salami slice the offerings. We think Netflix would fear this would stop consumers from diversifying and (eg) trying the odd documentary then finding they like them.

We don’t see an appetite sport or live music (as example of real time content), and someone else (Prime and Sky?) seems to have this for themselves.

One thing is inevitable — change. We’ll keep you posted.